THE GOOD

The Nigerian middle-class is growing demographically, expanding to make up 23% of the population according to Business Day. It is also getting wealthier, incomes rising in tune with the growth in the GDP.

Some of you, particularly those who live "abroad" may have done the Naira-to-Dollar conversion on Business Day's figures, and might be thinking this is not a lot of money we are talking about. But you would be missing the point if you did that. Let me put it this way, read the millions of articles praising places like Brazil, China and India for cutting poverty and growing their middle-class, and you will find that these are exactly the income numbers they used to make the optimistic case for the improvement in social welfare in those economies.

We Nigerians are an entrepreneurial people. As we say in pidgin, e go betta.

THE INTERESTING

Read this interview of Alhaji Sani Aminu Dutsinma, published by Daily Trust. He discusses non-interest banking, avoiding the sensationalism surrounding Sanusi Lamido Sanusi's move to establish guidelines for the establishment of non-interest banking institutions, and providing real information about what exactly is being proposed.

THE WORRYING

There is a difference between capitalism and the sort of the sort of thing that happens when business moguls and politicians collaborate to transfer publicly-owned de facto monopolies into private hands.

Why is the Securities and Exchange Commission in such a rush to "demutualize" (euphemism for "privatize") the Nigerian Stock Exchange? If ex-President Olusegun Obasanjo was still in office, I would have predicted they would "sell" it to Transcorp.

As near as I can tell, the current "Mutual" structure does not mean it is owned by government, rather that it is "owned" (sort of) by the members of the Stock Exchange (i.e. by anyone with trading rights on the Exchange).

I suppose the SEC would justify their move by pointing to the fact that many of the world's biggest stock exchanges demutualized in the last 20 years. We Africans like copying whatever we see other people doing, even if it is not relevant to our situation.

But more importantly, the demutualization of the world's major stock markets was one of several key parts of the process that led to the Great Recession, the global economic crisis of the last four years. It is not a good idea, no matter what doctrinaire ideologues might tell you.

THE UNCLEAR

It is probably the fault of the journalist who wrote this article, or maybe of the editor who published it. But you can make up your own mind after you read this report of a press conference held by Finance Minister Ngozi Okonjo-Iweala at the conclusion of the IMF and World Bank Annual Meetings.

To me, it seems to say a lot without saying anything. If she was quoted properly, she does seem to be laying all our problems at the door of the IMF, IFC and World Bank (and China), seemingly in the (unrealistic) hope that they will solve the problems for us. On the other hand, she was being asked about the IMF and World Bank Annual Meetings, so maybe she was just focusing on what those multilateral bodies could do for us. And on the third hand, she is career World Bank bureaucrat, who probably thinks that the road to Promised Land runs through the Bretton Woods.

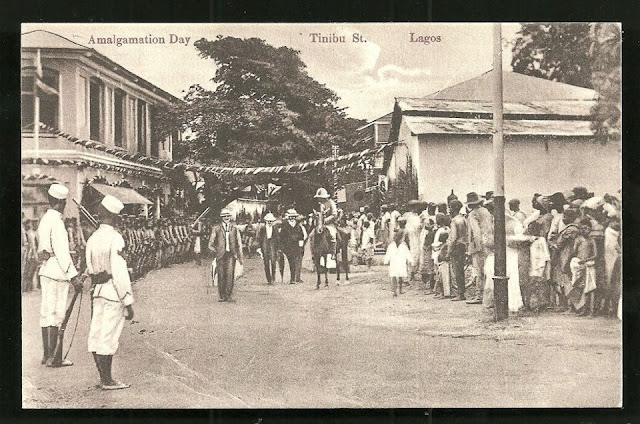

Amalgamation Day in Lagos, 1914

03 October, 2011

02 October, 2011

Good news on the banking front

It appears the long-running banking industry bailout and restructuring programmes are on the road to success. And the good news seems to have lifted the stock market.

Subscribe to:

Posts (Atom)